Report Background: Asiance X Open Survey

The Luxury Consumer Research Report 2023 is an exclusive annual report by Asiance. Based on a total of 800 Korean luxury consumers, the report provides key results and takeaways from Korean luxury consumer behavior in 2022. The report structure is largely divided into five sections: pre-purchase, purchase, online-purchase, post-purchase, and other related issues such as the impact of localization of official luxury brands sites, sustainability, metaverse, and the lifestyle of Korean luxury consumers.

Pre-Purchase Stage: How do Koreans look for luxury-related information before a purchase?

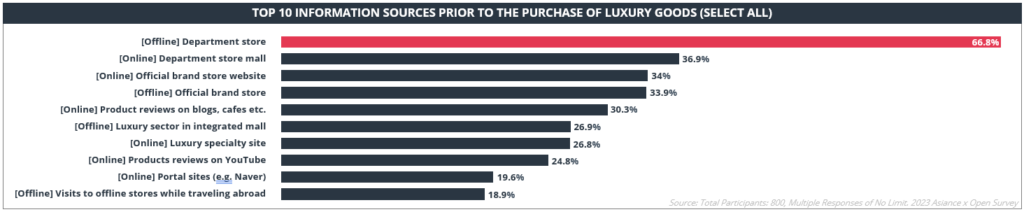

When looking for luxury-related information before an actual purchase, department stores both offline(66.8%) and online(36.9%) had the highest percentage of preference regardless of age or gender. The authenticity, credibility, and premium client service that department stores offer are expected to be the main reasons for visiting these channels. For the most cited factors when choosing information sources, ‘direct experience of trying on and comparing products’ was the most significant element offline while ‘the availability of various and trustworthy reviews’ was important online. For brands that want to offer more information about their brand and products online, local platforms such as Naver and Kakao can be utilized for better brand exposure.

Purchase Stage: How do Korean consumers purchase luxury goods?

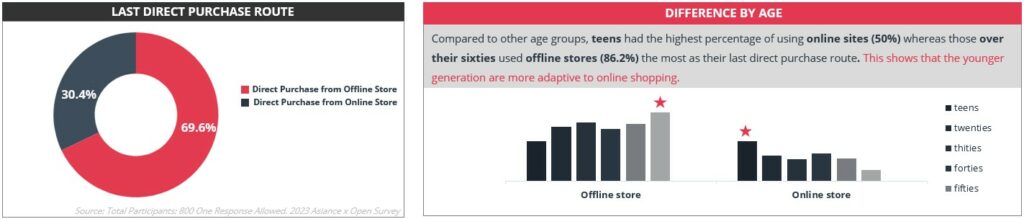

According to the survey results, those in their twenties had the highest average amount of money spent on luxury goods for 2022 reaching 84.65 M KRW, compared to the total average of 33M KRW. More consumers preferred direct purchases from offline stores(69.5%) over online stores(30.4%). Compared to other age groups, teens had the highest percentage of using online sites (50%) whereas those over their sixties used offline stores (86.2%) the most as their last direct purchase route. This shows that the younger generation is more adaptive to online shopping.

Post-Purchase Stage: How do Koreans react to luxury brand content?

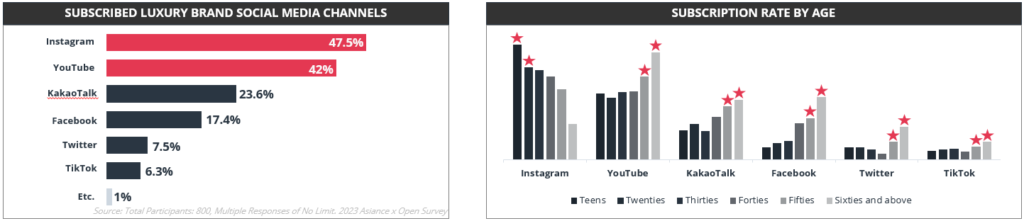

For all ages and genders, the most subscribed social media channels were Instagram and YouTube. It is noteworthy to see that the older generation (the forties and above) had a higher subscription rate for Youtube, KakaoTalk, Facebook, Twitter, and Tiktok compared to the younger generation(teens to thirties). The main reasons for subscribing to luxury brands’ social media channels were ‘in order to obtain information on new products(50.5%)’ followed by ‘in order to get an update on recent news related to the brand(31.2%)’ and ‘to get benefits offered by the brand(29%)’. Analyzing a brand’s target audience and focusing on the content that the audience group prefers is crucial to retain customer relationships.

Survey Demographics

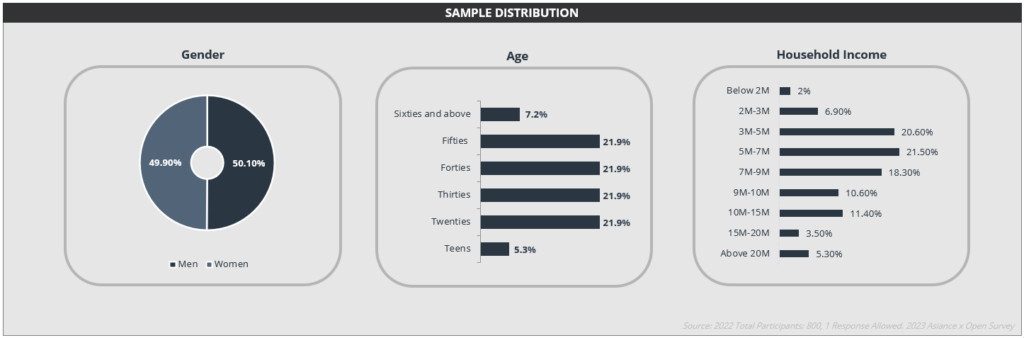

The research was conducted through an online survey with 800 Korean consumers that had experience purchasing premium luxury items in 2022. The gender distribution was nearly even with a 50.1-49.9% ratio, male and female respectively. The sample was also divided into six different age groups: teens, twenties, thirties, forties, fifties, and sixties and above. Throughout the report, the key results are analyzed by different age and gender groups.

Report Structure: 5 Stages

The LCR report is structured into five main sections: pre-purchase, purchase, online purchase, post-purchase, and other related issues. Online purchase was added exclusively because of the insights that online luxury shopping brings currently and the continuous and integral part of luxury consumption it will have. The report goes through key questions in each section with a general analysis, comparison, and contrast of the differences in age and gender.

- Pre-Purchase: How do Koreans look for luxury-related information before purchase?

- Purchase: How do Korean consumers purchase luxury goods?

- Online Purchase: What online channels do Koreans use to purchase luxury goods?

- Post Purchase: How do Koreans react to luxury brand content?

- Other Related Issues to Luxury: localization, sustainability, metaverse, and lifestyle

Download a preview version of the report through this link.

Contact us at insight@asiance.com to get your full Luxury Consumer Research Report 2023 today!